News + Trends

"The New York Times" sues OpenAI and Microsoft

by Samuel Buchmann

The gold rush around artificial intelligence is unending. Meanwhile, the real benefits of this technology remain limited. If this doesn’t change, the bubble will soon burst.

Generative artificial intelligence (AI) is the biggest tech hype since the internet. The giants of Silicon Valley are in a breakneck race. OpenAI, Microsoft, Google and Meta are trying to outdo each other with slick chatbots. The promise? AI will increase our productivity immeasurably.

Maybe. Someday. But current expectations are anything but realistic.

This can be seen on Wall Street. There, euphoria is running rampant. Investors are pumping huge amounts of capital into anything to do with AI – including Alphabet, Amazon, Meta, Microsoft and Nvidia. Between 1 January 2023 and 31 March 2024, around six trillion dollars flowed into the shares of these five companies.

6,000,000,000,000 dollars

This astronomical figure is almost seven times the gross domestic product of Switzerland (0.9 trillion) – and 22 per cent of that of the USA (27 trillion). As a result, the five companies increased their market capitalisation by 132 per cent. A large part of this increase is probably down to the high expectations of AI. The MSCI World global equity market index rose by only 31 per cent in the same period.

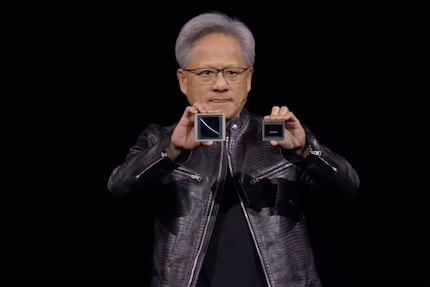

Plenty of capital is also flowing between the big companies – especially towards Nvidia. Alphabet, Amazon, Meta and Microsoft are buying as many AI processors as they can get their hands on. With them, they’re building the huge servers needed to train AI models and process requests. Nvidia’s Tensor Core GPUs are so far ahead of the competition that the chip manufacturer has a virtual monopoly.

As a result, CEO Jensen Huang can charge astronomical prices and earn a fortune. Nvidia’s margin is at almost 80 per cent, and profits rose by over 600 per cent last year. Today, Nvidia is worth as much as every company in Germany put together. For now, there’s no end in sight. Cloud providers have announced hundreds of billions in GPU investments for the rest of the year.

So far, Alphabet, Amazon, Meta and Microsoft can afford this. They’ve also increased their profits in recent years. At Meta, however, this is mainly due to cost-cutting measures and traditional income from advertising. It’s a similar story for Alphabet, Amazon and Microsoft. They also rent out cloud computing power to smaller companies that can’t get their own Nvidia GPUs.

Artificial intelligence isn’t where the profit comes from. Virtually no one is paying for premium subscriptions to chatbots or other AI features yet. While Microsoft and co. cross-subsidise the immense costs, start-ups at the bottom of the pyramid are burning venture capital from backers in the blast furnaces of cloud providers. And Nvidia’s sitting at the top.

In economic terms, artificial intelligence has so far been a black hole devouring power, labour and capital.

The whole thing is a Ponzi scheme based on hope. Hope that AI features will one day offer so much added value that companies and private users will pay a lot of money for them. Only then would the investments fully pay off. Until then, money will simply be shovelled up the pyramid and, in economic terms, artificial intelligence will remain a black hole. It devours vast amounts of energy, labour and capital.

Whether this’ll pay off in the end remains to be seen. Last year, ChatGPT caused a stir across the world – the language model awakened sci-fi fears. But the bot wasn’t only impressive, it was also unreliable. It made things up, relied on stereotypes and spread misinformation – just like the subsequent chatbots from Google and Meta. This unreliability was dismissed as an early misstep.

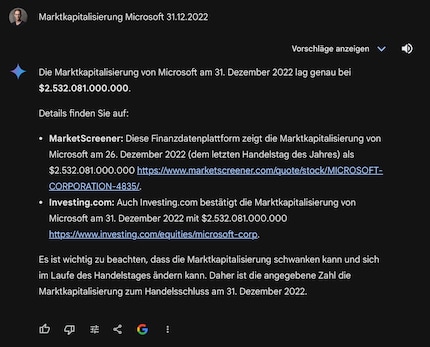

But it’s remained to this day. Google’s Gemini and OpenAI’s GPT-4o are still often wrong. Every request is like a coin toss. Maybe the answer will be correct, but maybe not. Regardless of whether it’s software code, medical advice or stock market data.

Google’s new AI Overview search suggests topping pizza with glue. And for this article, I wanted to know the market capitalisation of tech companies on 31 December 2022 according to Gemini. With full conviction, the AI sometimes made completely false statements. I haven’t found out where these come from, even with the sources stated.

Actual progress is happening in other places. On the one hand, the models are processing more and more data in less and less time. On the other hand, they can cope with different types of input at the same time. Images and spoken language, for example. Alphabet and OpenAI are also polishing the language output of their AI to a high gloss. Sky, the AI voice of GPT-4o, was so reminiscent of Scarlet Johansson in the movie Her during her debut that the actress called in her lawyers.

Such features make headlines and suggest rapid development. But these are mostly smoke grenades to distract from the basic problem – AI models aren’t ready for the market because they just make too many mistakes. They’re like a bad intern who has to be constantly monitored.

This problem isn’t really easy to solve. Contrary to its name, artificial intelligence merely generates output from existing data. It can’t tell the difference between serious information and a meme from Reddit. And according to reports, AI companies are already running out of data with which they could further improve their models. OpenAI and Google have scoured the entire internet, largely without compensating the authors of the content, leading to more lawsuits.

Even if you disregard legal and ethical concerns, there will be a structural problem at some point. Google’s AI Overview could ensure that traffic stays with Google. This would cause the business model of many websites to disappear – and thus also the incentive to produce new content at all. But it’s precisely this content that provides the necessary nourishment for the data octopuses of current models. AI bites the hand that feeds it.

Perhaps Silicon Valley will still find a solution. One approach, for example, could be specialised models trained with less but better data. Artificial intelligence is undoubtedly a useful technology. There are applications, and there will be many more that nobody has thought of yet. But the revolution may come more slowly and less comprehensively than the hype suggests.

What if artificial intelligence remains stupid?

For now, investors still have patience. They’re happy for Google and Microsoft to present new AI products every few months – regardless of whether they’re any good. Nobody knows how long this will last. But the moment of truth will come, and the bubble is full to bursting.

What if chatbots remain stupid? What if no one needs Copilot+ PCs? What if large industrial corporations reduce their AI investments because they can’t see benefits any more? What if all the AI start-ups don’t become profitable after all? What if the demand for cloud computing power disappears along with their failed business models? What if Microsoft, Meta, Amazon and Alphabet suddenly no longer need as many GPUs from Nvidia?

Pop.

My fingerprint often changes so drastically that my MacBook doesn't recognise it anymore. The reason? If I'm not clinging to a monitor or camera, I'm probably clinging to a rockface by the tips of my fingers.

This is a subjective opinion of the editorial team. It doesn't necessarily reflect the position of the company.

Show all